In boardrooms and investor calls, revenue often steals the spotlight. A growing top line feels like success. But seasoned CFOs know better, profitability, not revenue, is the real measure of sustainable business growth.

Too many companies chase sales volume without understanding the cost structure behind those wins. Margins shrink, expenses climb, and leadership is left wondering why a revenue surge didn’t translate to stronger earnings.

Profit vs Revenue: What’s the Difference?

Revenue is the total amount of money your business brings in. It’s important, but incomplete. Profit is what’s left after covering your costs; what the business actually keeps. You can grow revenue and still lose money if margins are thin or overhead is bloated.

A CFO’s job is to bridge that gap. We ask tougher questions:

- What are we spending to earn each dollar?

- Which products or services drive profit, not just revenue?

- Where can we improve net income without cutting corners?

Why Profitability Drives Long-Term Health

Revenue may impress in the short term, but profit funds everything from hiring and innovation to debt reduction and dividends. High-revenue companies can still face cash crunches, layoffs, or stalled growth if they’re not watching the bottom line.

Profitability also gives businesses room to maneuver, especially in downturns. Companies with strong margins have options. They can reinvest, pivot, or weather storms while competitors fold.

CFO Advice for Growth That Lasts

If you want sustainable business growth, it’s time to look beyond top-line numbers. Profitability offers a clearer view of how healthy and scalable your business really is.

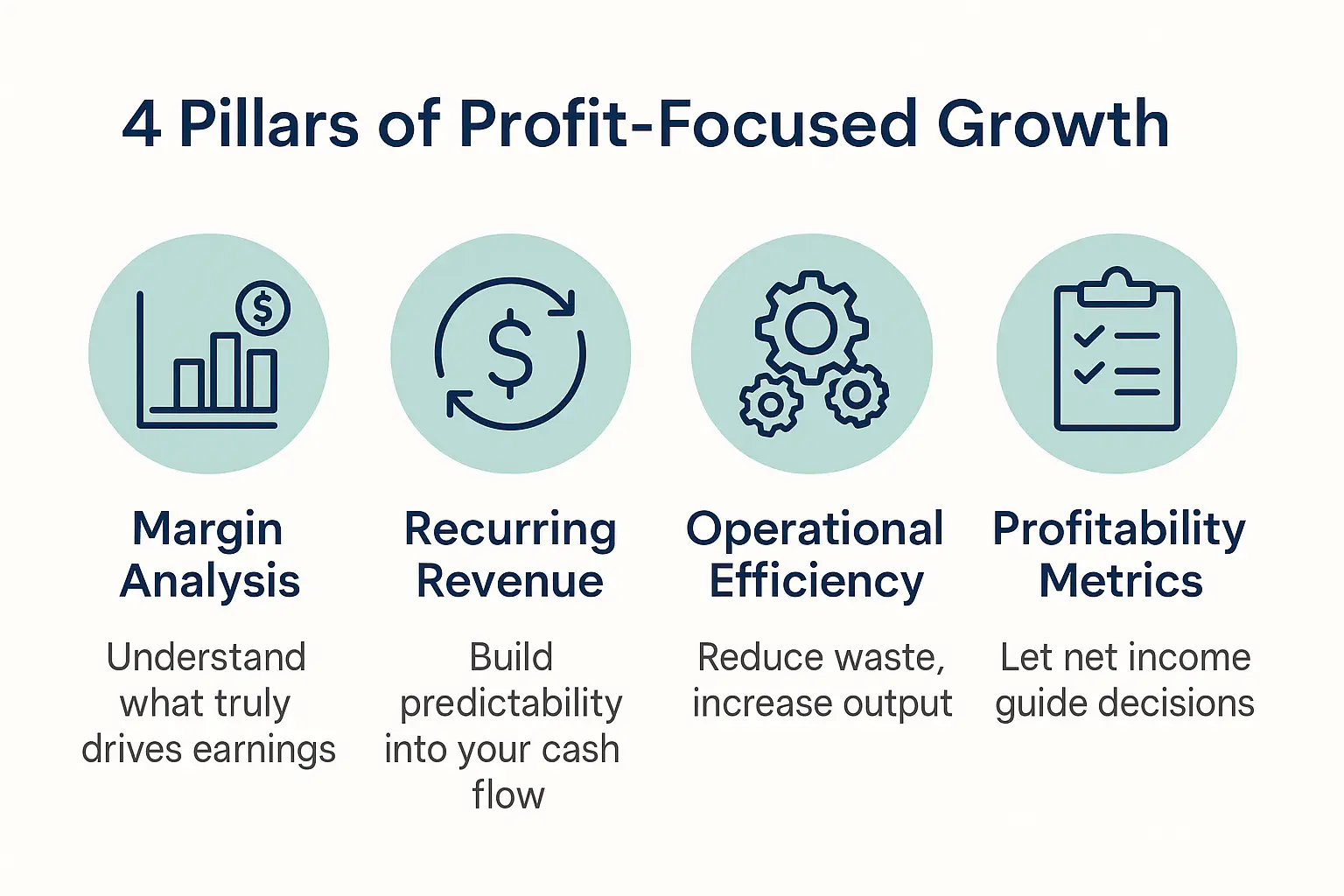

Start by analyzing margins across all business lines. Not every product or service contributes equally to your bottom line. Dig into gross margin and operating margin by segment. You may find that some areas are underperforming or even losing money, despite strong sales.

Next, prioritize recurring revenue models with predictable costs. Subscription-based services, long-term contracts, and retainers provide steady income and reduce reliance on one-time sales. When paired with a lean cost structure, these models build stability.

Operational efficiency is another key driver. Look for ways to streamline processes, cut waste, and improve productivity. That might mean upgrading systems, renegotiating vendor contracts, or refining your hiring strategy to align with revenue per employee goals.

Most importantly, track the right metrics. Use net profit margin, EBITDA, and return on invested capital to guide decisions. These indicators reveal how well your company turns revenue into actual earnings and long-term value.

In summary, if you want sustainable business growth, shift your focus:

- Analyze margins across all business lines.

- Prioritize recurring revenue models with predictable costs.

- Streamline operations to reduce waste and improve efficiency.

- Use profitability metrics—like net margin and EBITDA—to guide strategy.

Revenue growth looks good in headlines. Profit growth keeps the business alive—and gives you the flexibility to invest, adapt, and scale with confidence.